With the rising cost of living, interest rates and the price of eggs (seriously eggs are now luxury items) there is a lot of uncertainty and anxiety surrounding spending and saving habits. A study published the other day indicated that about 60% of millennials aren’t confident they can retire by 65. The majority have stated they could not handle a sudden expense of $500.

With all the anxiety around finances and the economy, now is the time to rein in those unnecessary spending and build a nest for the stormy days. Some people are good at saving and others struggle with the concept. Financial literacy and health are vital to surviving this economic downtown. There are several ways to kick-start a beneficial saving habit, but some can be boring and lack accountability.

The envelope challenge which has taken the social media world by storm is one of several ways to save money in an interesting and creative way.

What is the envelope challenge?

The envelope challenge is a money-saving challenge where you use envelopes to consciously and consistently save money in a short amount of time. With the challenge you:

Write numbers (1-100 or 1-50) on an envelope

Shuffle the envelopes like a deck of cards

Pick an envelope every day and deposit the amount written on it

Seal the envelope and put it away

For example on day 5 you draw an envelope with the number 45 written on it, you would then deposit $45 into that envelope and store it. By the end of the challenge, you should have a significant amount of money stored.

What you need to do the envelope challenge

Envelopes: These can be simple white envelopes or you can choose to go colourful and fancy. You will need the exact amount for the challenge you select for example 100 envelopes for the 100-Day Envelope Challenge.

Sharpies: To be used to write the amount on the front of the envelope.

Cash: You can withdraw a certain amount when you get paid or run to the bank every day.

Box or container: To store the envelopes in.

Calendar: To keep track of the days.

Types of envelope challeng

100-day envelope challenge

As the name suggests the challenge will last for 100 days and you can save over $5000 in a little over 3 months.

I found this challenge difficult because of my many financial responsibilities (bills, bills, bills) but this can be done if you don’t have a lot of expenses and plenty of disposable income. However, while I failed to complete this challenge it really helped me to rein in my unnecessary spending and made me think twice about buying that pair of shoes I don’t necessarily need.

50-day envelope challenge

Like the 100 Envelope Challenge, the same rules apply here only this challenge is shorter and you save less money. With this challenge, you can save a little over $1200 dollars in less than two months. Though it’s less than 100 days it may still prove difficult for those persons who don’t have a certain amount of disposable income.

I failed both these envelope challenges due to financial commitments and responsibilities so I created a challenge of my own that can be modified based on my own budget and goals.

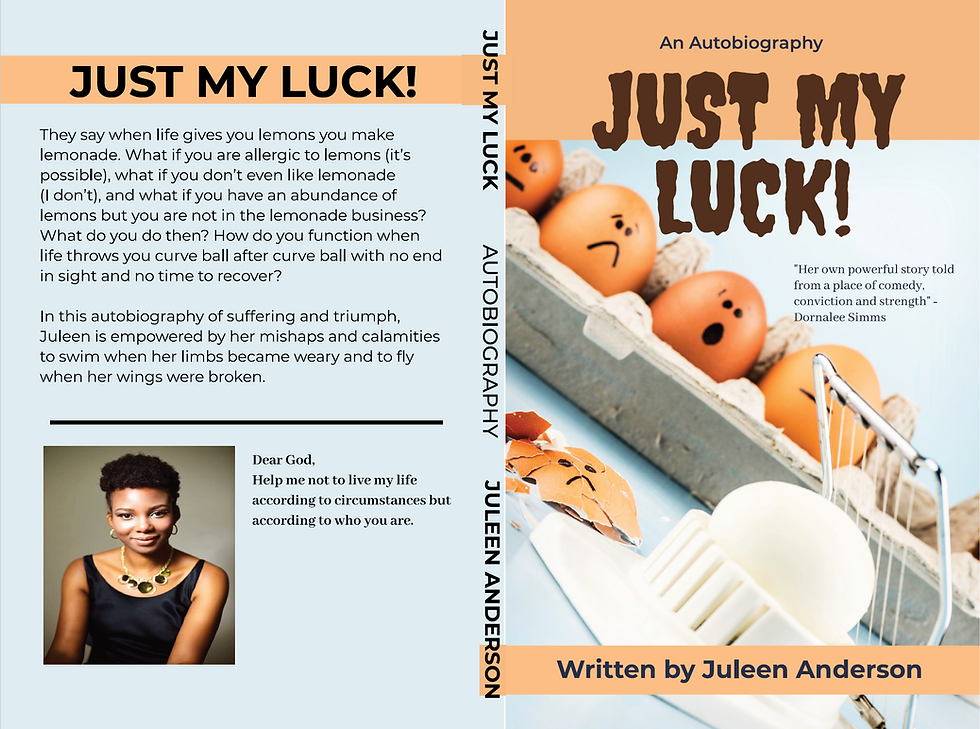

Still available for purchase. Get your copy today on Amazon.

Click the Amazon button below and select your country.

Juleen’s 52-Week Sunday Morning Savings Challenge

This challenge is manageable even for those whose finances are tight with limited disposable income. You deposit a selected amount every Sunday morning in an envelope or bank account for 52 weeks. The amount has to be consistent as well as the day of the week. For example, you can save $10 a week every Sunday morning for 52 weeks and at the end of that time you would’ve accumulated over $500.

This challenge can be modified based on what you can afford. You can start with as little as $5 dollars a week and up to $1000 a week. You can also increase or decrease the amount based on your circumstances. For example, if you got a raise in salary you may be able to increase the amount deposited every week. The main idea is to deposit the same amount of money in an inaccessible account every Sunday morning. I say inaccessible because this will deter you from withdrawing the money. I deposit mine in an account to which I have no debit cards and the only way to access the money is to drive 20 miles to the closest bank.

This challenge is helping me to save for my summer vacation.

All of these challenges can be modified and don't necessarily have to follow 100 or even 50 days. You can do a 30 day envelope challenge or a 75-day envelope challenge. The endgame is to save as much money as possible using a creative method that fosters healthy spending and saving habits and financial accountability.

So if you have been eyeing a house, car or vacation in Greece, these challenges, modified to your needs and budget can help you save towards your goals.

Julz out!

Yorumlar